Modern travel is much more accessible, but it can also be more difficult to plan. Controlling your finances during your vacation is equally vital as planning your route, purchasing tickets, and reserving accommodations. Expenses often spiral out of control, and when you get home, it’s tough to figure out where the money went. If you want to avoid financial disaster, learn to manage your expenses in real time. Financial apps for smartphones can help you do this simply and effectively.

Financial Apps for Controlling Expenses While Traveling. Advantages

By tracking your costs in real time, you can avoid unforeseen circumstances and keep your budget on pace. You also have a clear overview of your list of expenses.

With an expense tracker, you will enjoy the following benefits.

- Automated expense tracking.

Most apps will automatically collect data from your bank cards, thus making it easier to monitor your spending.

- Transparency of your financial situation.

You always see your balance, so you can adjust your spending in real time.

- Expense categorization.

You track your expenses by category, which allows you to better analyze your financial flows.

- Budget planning.

With the best budget monitor, you can set spending limits for different categories and avoid overspending.

When moving on to various solutions and appropriate tools, we cannot ignore the technological side of the issue. After all, effective expense tracking is impossible without a high-quality technological base. The modern market offers many technological solutions for financial products, including digital banking. If you are thinking about creating your own financial service or are looking for a flexible solution for your business, take a look at platforms similar to white label fintech platform. Such platforms are developed by experienced professionals from fintech software development company. It allows you to quickly launch custom banking solutions, which can include both expense accounting functionality and a full-fledged banking backend. You’ll find it useful for both new fintech startups and existing companies looking to expand their range of services.

Returning to our topic, we should take a closer look at which travel expense tracking apps are the most effective and popular today.

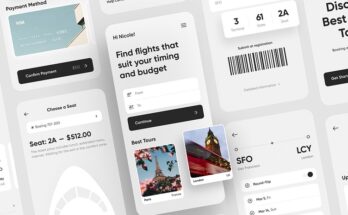

Main Types of Financial Apps for Travel

- For personal expenses

- For budget planning

- For timely bill payment

Expense Tracker for personal expenses

They allow you to keep track of all your expenses while traveling, namely:

- Manually or automatically add transactions,

- Set the currency of your trip,

- Save receipts as photos,

- Get instant spending analysis.

The most popular best Android apps in this category are as follows.

- Money Manager

- Easy-to-use interface,

- Detailed income and expense tracking.

- Wallet by BudgetBakers

- Flexible expense tracking,

- Synchronization with banks,

- Joint budget management for groups of travelers.

- Spendee

It allows you to create multiple wallets for different trips and categories.

Best Budget Monitor for budget planning

Apps that act as the best budget monitor allow you not only to control your expenses, but also to plan ahead. Namely,

- Set a daily or total travel budget.

- Set limits for expense categories.

- Receive notifications when you exceed your budget.

Bill Tracker App for timely bill payment

During long trips, don’t forget about your regular bills. These can include phone, insurance, or subscription payments. This is where the bill tracker app comes in handy. It will remind you that you must make your payments on time, even if you are abroad.

Effective Use of Financial Apps While Traveling

Create a personalized expense tracking strategy.

- Install the app before your trip. Familiarize yourself with its features.

- Make a basic list of expenses that your trip will entail.

- Create a preliminary budget by category.

Regularly add new expenses to the app.

Do this to get a realistic picture of your financial situation. You can also connect your bank account for automatic data updates.

Analyze your expenses.

Thanks to spending analysis, you can view detailed expense reports at the end of each day or week. Based on this, you can adjust your financial behavior during your trip, rather than after it is over.

Monitor time spent in apps.

To strike a balance between fun and financial discipline, employ tools that reveal how much time you spend on apps. In this way, you can avoid becoming overly obsessed with financial monitoring.

Additional features for ease of use

Many modern tracking apps offer additional features that make it much easier to control your spending. These include:

- Support for multiple currencies,

- Automatic recognition of expense categories,

- Shared access for multiple users,

- Integration with calendars or messengers.

Which apps can be classified as easy expense apps

If you need the simplest app without complicated settings, check out easy expense solutions. These apps are suitable for those who just want to control their budget without in-depth analysis and additional features. They are distinguished by the following features:

- Intuitive interface.

- Simple income and expense tracking without unnecessary settings.

- Basic functionality for daily accounting.

Conclusion

Thanks to modern financial apps, real-time expense tracking while traveling is no longer a difficult task. Various expense tracker, bill tracker, and other tracking apps will help you keep your finances in check and avoid overspending. Whether you choose the best budget monitor for extensive planning or a simple easy expense app for rapid accounting, the most essential thing is to take a mindful attitude to your spending. This way, every trip will be not only interesting but also financially predictable.